These processors not only allow your nonprofit to accept credit or debit cards, they also can process electronic checks through ACH (automated clearing house). These include iATS Payments, Blue Pay, Heartland, Stripe, and PayPal. Thankfully, there are several payment processors designed specifically to work with nonprofits. This usually involves a payment processor that handles credit or debit card transactions between donors and the nonprofit. We touched on this briefly above, but for nonprofits payment processing, as noted by Double the Donation, “describes the handling of donors’ financial information whenever they make an online donation transaction.” This could be “submitting a donation, buying merchandise, paying a membership fee, or registering for an event.” For more advice, such as invoicing best practices and how get invoices paid faster, check out this useful Ultimate Guide to Invoicing.

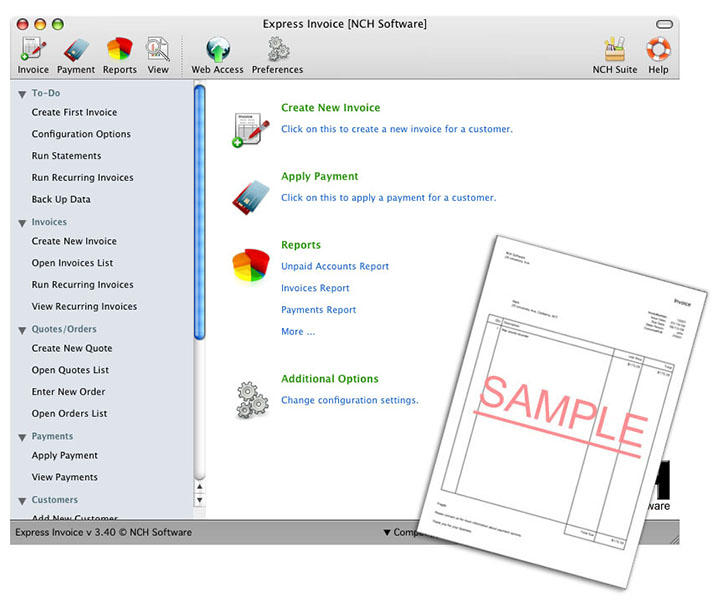

Free invoicing software nonprofits how to#

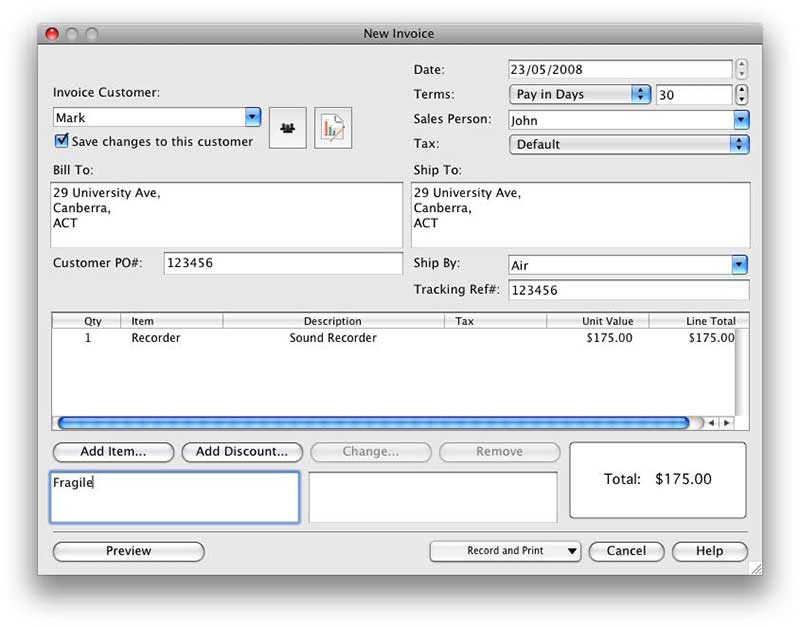

That information just covers how to create a professional invoice. For example, late fees or early payment discounts.įinally, include your preferred payment options, such as checks or PayPal. Underneath the total you’ll want to include any additional information, such as terms and conditions.

Quantity: This includes either how many hours you worked or how many products you sold.Date: This would be the date that the service was performed or when a product was purchased.Services: This is the description of the work you performed.This part of the invoice usually includes the following separate columns: This information will include the following on separate line: Invoice Number Date prepared Payment due date and Preferred payment option. It should be placed below the header, but on the opposite side.Īcross from the recipient’s information, you need to add the invoice details. This information includes the recipient’s name, address, and phone number. Consider using a larger font or making your nonprofit in bold print to stand out. You will need your mailing address, phone number, email address, and website, underneath your business name. It also includes your contact information. The header consists of your organization’s name and is placed at the top of your invoice in an easy-to-read font. As one of our invoicing tips for nonprofits, create a professional invoice that contains: When it comes down to it, creating an invoice for a nonprofit is the same as any other invoice. Implement These Invoicing Tips For Nonprofits.Remain loyal to the donor - even with late pledges. Don’t forget about taxes and regulations.

0 kommentar(er)

0 kommentar(er)